Navigation

Power Companies Focus on Clean Energy Deals

Environment-friendly regulators and lawmakers have acquisitive power companies wary of potential policy changes on greenhouse gas emissions.

Environment-friendly regulators and lawmakers have acquisitive power companies wary of potential policy changes on greenhouse gas emissions. As they weigh deals, companies are adjusting their criteria for the impact of greenhouse gases, said David Nastro, managing director and co-head of global power and utilities at Morgan Stanley.

Among their considerations are proposals being reviewed by the US Senate that address climate change through measures including emissions reductions and a cap-and-trade policy allowing emissions credit trading. At the same time, proposed power plants have met with increased regulatory scrutiny.

Last month Kansas officials denied permits for proposed coal-fired generators by the Sunflower Electric Power Corp., citing the potential harm of greenhouse gases like carbon dioxide.

"That was the first plant in the country canceled because of carbon concerns and it really shook the industry," said William DeGrandis, a partner at law firm Paul Hastings. "This wasn't California or Florida, this was Kansas."

"The question becomes to what extent will similar plants being planned be impacted by similar opposition?" DeGrandis added.

Such questions are factoring into energy and utility deal making, which has seen over 900 transactions so far this year, totaling nearly US$260 billion -- an increase of about 30 percent over last year, according to data provider Dealogic.

|

| A solar trough array Photo: Wikipedia |

Uncertainty over clean energy policies may drive deals that result in fuel or regulatory diversification for power companies. By diversifying, companies could reduce the influence that any one local regulatory body or policy could have on a company's total combined operations.

Houston-based Dynegy Inc and Florida's FPL Group Inc have recently targeted acquisitions that would provide fuel or geographic variety.

In addition to diversification, deals that bulk up a company's balance sheet may also be attractive due to the increased costs associated with cleaner energy.

"The capital intensive nature of tomorrow's generation investment is so great that it will drive some mergers," said Stuart Caplan, a partner at law firm White & Case. "The bottom line is that one driver for mergers is bigger is better."

Potential clean energy costs may also make power markets less appealing to players like private equity firms that may not have the political clout with regulators as long-time industry players.

Last year, Dynegy agreed to acquire the power plants of private equity fund LS Power Group for about US$2 billion in cash and stock, nearly doubling its generating capacity and expanding its geographic reach.

Green Seat at the Table

|

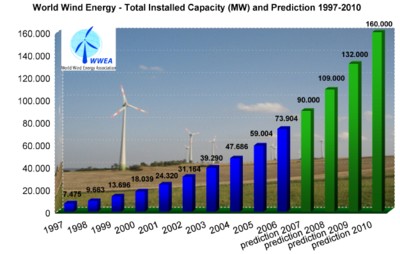

| Wind power: worldwide installed capacity and prediction 1997-2010, Source: World Wind Energy Association (WWEA) |

As management teams assess their ability to do transactions, they are also an increasingly focused on the response of environmental organizations.

The buyout of Texas power company TXU Corp, acquired in October by a group including private equity firms Kohlberg Kravis Roberts & Co and Texas Pacific Group for about US$32 billion, had the blessing of environmental groups Environmental Defense and Natural Resources Defense Council.

TXU and its new buyers made several pledges to improve the company's environmental policies, such as cutting back on the number of coal-fired power plants it would seek to build. Until that acquisition, environmentalists had not been seen as having a seat at the negotiating table in power company deals.

"Going forward we expect this interaction to be an integral part of any strategic combination," said Morgan Stanley's Nastro.

Article by Jonathan Keehner with reporting by Jonathan Keehner and Editing by Tim Dobbyn

For Planet Ark, November 19, 2007

Reprinted with permission. © Reuters News Service 2007.

Note:

WWEA will soon publish "Wind Energy International 2007/2008" the new edition of the international standard wind energy yearbook with 66 country reports and 36 special reports.

Search

Latest articles

Agriculture

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

Air Pollution

- "Water and Sanitation-Related Diseases and the Changing Environment: Challenges, Interventions, and Preventive Measures" Volume 2 Is Now Available

- Global Innovation Exchange Co-Created by Horizon International, USAID, Bill and Melinda Gates Foundation and Others

Biodiversity

- It is time for international mobilization against climate change

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

Desertification

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

- UN Food Systems Summit Receives Over 1,200 Ideas to Help Meet Sustainable Development Goals

Endangered Species

- Mangrove Action Project Collaborates to Restore and Preserve Mangrove Ecosystems

- Coral Research in Palau offers a “Glimmer of Hope”

Energy

- Global Innovation Exchange Co-Created by Horizon International, USAID, Bill and Melinda Gates Foundation and Others

- Wildlife Preservation in Southeast Nova Scotia

Exhibits

- Global Innovation Exchange Co-Created by Horizon International, USAID, Bill and Melinda Gates Foundation and Others

- Coral Reefs

Forests

- NASA Satellites Reveal Major Shifts in Global Freshwater Updated June 2020

- Global Innovation Exchange Co-Created by Horizon International, USAID, Bill and Melinda Gates Foundation and Others

Global Climate Change

- It is time for international mobilization against climate change

- It is time for international mobilization against climate change

Global Health

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

- More than 400 schoolgirls, family and teachers rescued from Afghanistan by small coalition

Industry

- "Water and Sanitation-Related Diseases and the Changing Environment: Challenges, Interventions, and Preventive Measures" Volume 2 Is Now Available

- Global Innovation Exchange Co-Created by Horizon International, USAID, Bill and Melinda Gates Foundation and Others

Natural Disaster Relief

- STOP ATTACKS ON HEALTH CARE IN UKRAINE

- Global Innovation Exchange Co-Created by Horizon International, USAID, Bill and Melinda Gates Foundation and Others

News and Special Reports

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

- STOP ATTACKS ON HEALTH CARE IN UKRAINE

Oceans, Coral Reefs

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

- Mangrove Action Project Collaborates to Restore and Preserve Mangrove Ecosystems

Pollution

- Zakaria Ouedraogo of Burkina Faso Produces Film “Nzoue Fiyen: Water Not Drinkable”

- "Water and Sanitation-Related Diseases and the Changing Environment: Challenges, Interventions, and Preventive Measures" Volume 2 Is Now Available

Population

- "Water and Sanitation-Related Diseases and the Changing Environment: Challenges, Interventions, and Preventive Measures" Volume 2 Is Now Available

- "Water and Sanitation-Related Diseases and the Changing Environment: Challenges, Interventions, and Preventive Measures" Volume 2 Is Now Available

Public Health

- Honouring the visionary behind India’s sanitation revolution

- Honouring the visionary behind India’s sanitation revolution

Rivers

- World Water Week: Healthy ecosystems essential to human health: from coronavirus to malnutrition Online session Wednesday 24 August 17:00-18:20

- Mangrove Action Project Collaborates to Restore and Preserve Mangrove Ecosystems

Sanitation

- Honouring the visionary behind India’s sanitation revolution

- Honouring the visionary behind India’s sanitation revolution

Toxic Chemicals

- "Water and Sanitation-Related Diseases and the Changing Environment: Challenges, Interventions, and Preventive Measures" Volume 2 Is Now Available

- Actions to Prevent Polluted Drinking Water in the United States

Transportation

- "Water and Sanitation-Related Diseases and the Changing Environment: Challenges, Interventions, and Preventive Measures" Volume 2 Is Now Available

- Urbanization Provides Opportunities for Transition to a Green Economy, Says New Report

Waste Management

- Honouring the visionary behind India’s sanitation revolution

- Honouring the visionary behind India’s sanitation revolution

Water

- Honouring the visionary behind India’s sanitation revolution

- Honouring the visionary behind India’s sanitation revolution

Water and Sanitation

- Honouring the visionary behind India’s sanitation revolution

- Honouring the visionary behind India’s sanitation revolution